Understanding Warren Buffett’s Circle of Competence: How to Invest Wisely

Warren Buffett, one of the greatest investors of all time, has a simple yet powerful concept at the core of his investment strategy—the Circle of Competence. This principle has guided Buffett’s decisions for decades, helping him avoid costly mistakes and stay focused on what he knows best.

In this blog, we’ll explore:

✔ What the Circle of Competence means

✔ Why it’s crucial for investors (and professionals in any field)

✔ How to identify and expand your own circle

✔ Real-world examples of Buffett applying this concept

What Is the Circle of Competence?

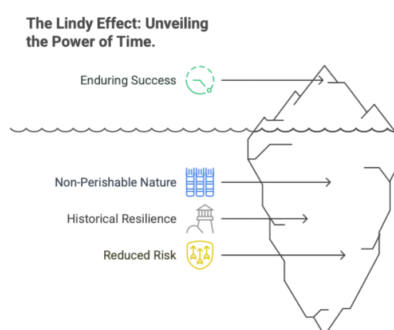

The Circle of Competence is the idea that every individual has areas where they have deep knowledge and expertise—and areas where they don’t. Buffett’s rule is simple:

“Know your circle of competence, and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital.”

In investing, this means only putting money into businesses or industries you truly understand. If something falls outside your circle, no matter how tempting, Buffett advises staying away.

Why the Circle of Competence Matters

1. Reduces Risk

Investing in unfamiliar industries increases the chances of mistakes. By staying within his circle, Buffett avoids unnecessary risks.

2. Builds Confidence

When you operate within your expertise, you make better decisions because you understand the key drivers of success.

3. Prevents FOMO (Fear of Missing Out)

Many investors chase trends (like crypto or AI stocks) without understanding them. Buffett skips these if they’re outside his circle, avoiding bubbles.

How to Define Your Circle of Competence

1. Assess Your Knowledge

-

What industries do you understand deeply?

-

Which business models make sense to you?

-

Where do you have real-world experience?

2. Be Honest About Blind Spots

Buffett avoided tech stocks for years because he didn’t understand them—until Apple, which he studied thoroughly before investing.

3. Stay Disciplined

Even if everyone is investing in a hot sector (like blockchain), don’t follow blindly unless it fits within your circle.

How Buffett Applies This Principle

✅ Avoided Dot-Com Bubble – Buffett didn’t invest in internet stocks in the 1990s because they were outside his circle. While he missed some gains, he also avoided massive losses when the bubble burst.

✅ Invested in Coca-Cola & Banks – Buffett understood consumer brands and financial businesses, so he invested heavily in companies like Coca-Cola and Bank of America.

✅ Later Embraced Apple – Once he studied Apple’s business model and moat, he added it to his portfolio, showing that circles can expand with learning.

How to Expand Your Circle (Safely)

Buffett doesn’t recommend staying stagnant—just being cautious. To grow your circle:

📚 Study Continuously – Read annual reports, follow industry trends, and learn from experts.

🤔 Start Small – If entering a new area (e.g., tech), invest small amounts first to test your understanding.

🔄 Learn from Mistakes – Even Buffett has made errors (like IBM), but he learns and adjusts.

Final Thought: Stay in Your Lane (Until You’re Ready to Expand)

The Circle of Competence isn’t about limiting yourself—it’s about investing and operating with confidence. By knowing what you understand (and what you don’t), you make smarter decisions, whether in stocks, business, or career choices.

As Buffett says:

“Risk comes from not knowing what you’re doing.”

So, define your circle, stick to it, and expand it wisely.